Ventures & Emerging Brands

Mapping the future of food and beverage for The Coca-Cola Company

My role and that of Venturing & Emerging Brands (VEB) itself, a tangential group within The Coca-Cola Company, was in three parts:

Futurist (project category trends)

Investment Advisor (venture capital, M&A)

Brand Incubator (grow nascent brands)

The retail revenue of VEB brands fell with the <$10M to $150M range, with marketing budgets ~10 to 20% of that sum.

In my role, I lead a range strategic projects for the portfolio, many of which are noted in this image, to support and advance the three areas noted above. Highlights from a couple are included below.

VEB Sweet Spots

THE BRIEF

To better direct investments by the group, both for newly acquired brands and innovation on the current portfolio, a “roadmap” was required to project the category landscape in the near (today to 5 years), mid (5 to 10 years) and long (10+ years) term.

THE RESPONSE

Due to confidentiality, I have restricted the below references to my work that is also covered at vebatcoke.com.

To ensure a holistic view of the future landscape, I identified and led multiple work streams under four distinct areas that shape the category:

Government: while it lags behind the other areas, government regulation greatly shapes the landscape. Consider the sugar regulation imposed by some states and how that impacts consumer’s choice in food and beverage or how the FDA recently updated nutritional standards. I partnered with legal council who specializes in Scientific & Regulatory Affairs to gain perspective into current trends and on-going industry discussions that would ultimately shape the food and beverage landscape.

Market / Entrepreneurs: entrepreneurs of food and beverage brands are often well ahead of consumer demand. By continued monitoring of regional brands and keeping a close ear to the street on what the industry is buzzing about, insights emerged that also provided indicators on where the market may be heading.

Retail: as consumer’s preferences evolve, so do the way they shop and what they expect from retail. By examining in detail various trends within the retail channel, correlations to consumer desire and need are revealed. For instance, we see an evolution within the convenience retail channel of floor space being converted to cold vault space, a result of increased demand for natural and fresh products.

Consumer: intense qualitative and quantitative research was conducted to better understand the shifting preferences of consumers. Further, segmentation was conducted to no only prioritize investments, but to identify cohorts who are the bellwether of future trends.

At the intersection of these four areas, the VEB “Sweetspots” were defined across a near, mid and long term map.

THE RESULT

The Sweetspots provided actionable and tangible strategic guideposts to direct investments in new brands, as well as innovation on the current portfolio. For instance, it guided near term innovation on Suja (functional shots) and Zico (coco-lixirs), as well as investment in/acquisition of Body Armor and Health-Ade.

The Art of Emerging

THE BRIEF

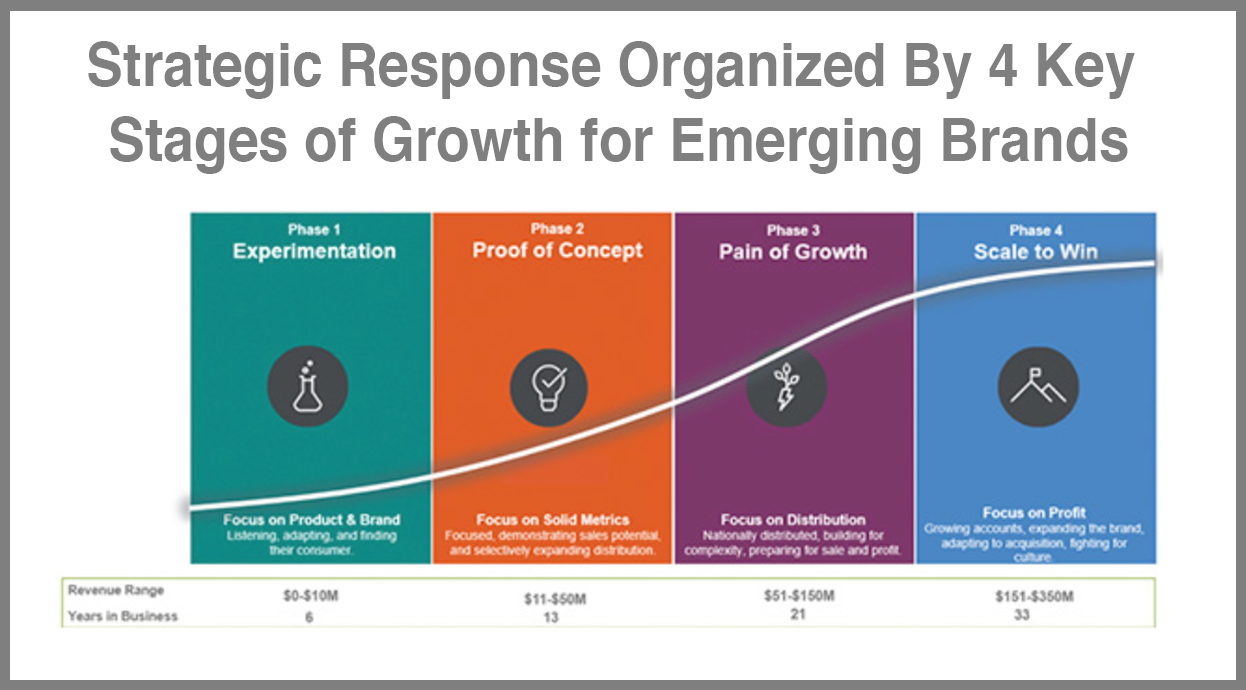

The VEB group has stakes in many emerging brands in various stages of growth, whether through owned, direct or indirect investment. While The Coca-Cola Company was incredibly skilled at growing established brands and had much codified material on how to best do so, this was less the case with emerging ones. To address this gap, a strategic treatise on best practices for emerging brands was required, which answered a host of questions, such as:

By stage of development, what are the most effective and efficient scaling strategies to sustainably scale a brand?

By stage of development, what is the appropriate level of marketing investment?

By stage of development, what are best practices of engaging retailers?

By stage of development, how do you best create and maintain a winning culture within an organizations?

THE RESPONSE

As it was clear this type of enterprise thinking would generate high value for brands across the portfolio, a robust project was initiated, dubbed “The Art of Emerging.”

I lead multiple workstreams and cross-functional teams to tackle various questions. It was a mix of bespoke qualitative and quantitative research, robust interviews with brand founders across the industry, and in-depth analysis of case studies from many successful and failed brands.

The response was organized by the brand’s stage of growth, which is generally identified by the it’s retail revenue. Within each stage, analysis and guidance is provided around five areas: mission & purpose, culture & organization, commercial & route to market, consumer & marketing, and finance & investment.

THE RESULT

The end result was a strategic playbook to support decision making on investments and advise brands in our portfolio on how to best grow.

Not only did this provide answers to many of the questions we often received from brand leaders, but it also showed the value VEB could provide to prospective brands, further establishing the group as a leader in the emerging, natural beverage landscape.

A Strategic Point-Of-View: Applying Masterbrand Strategy

THE BRIEF

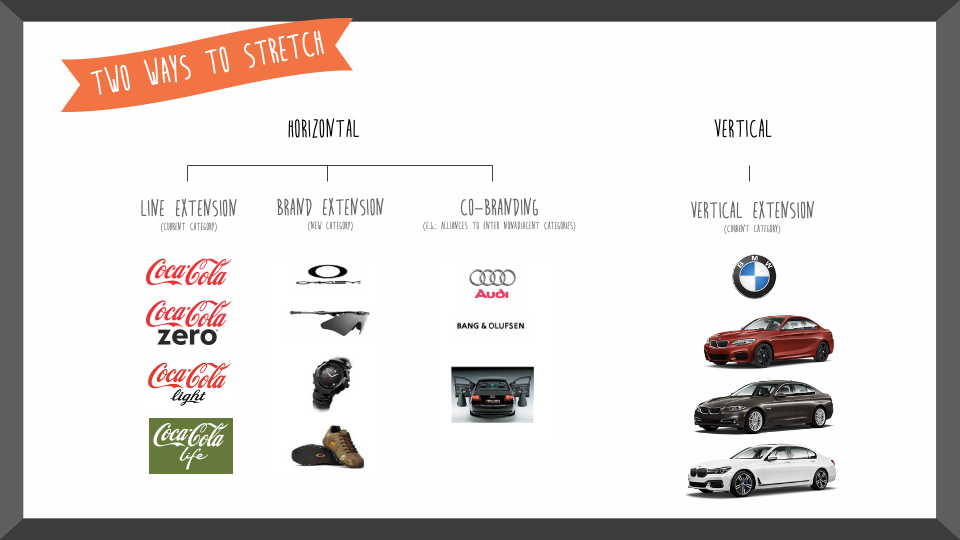

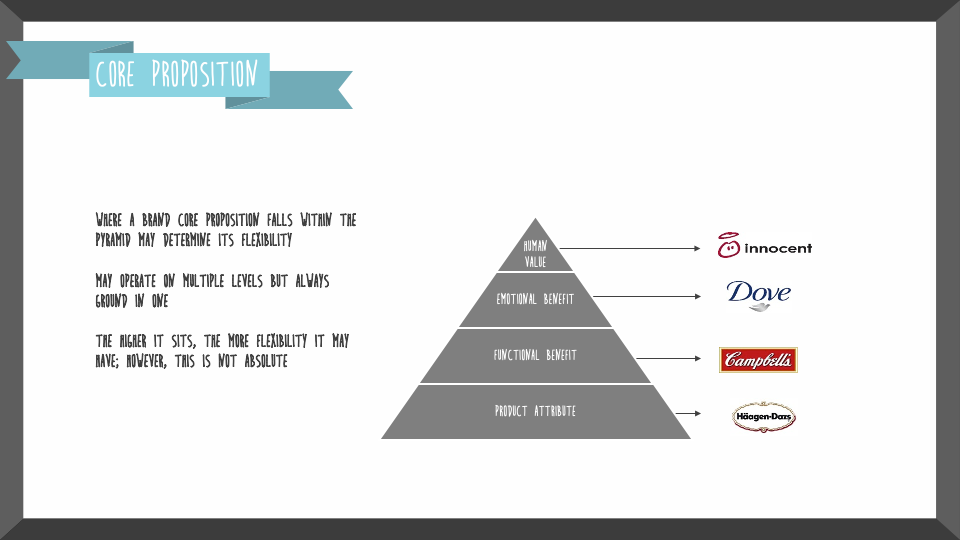

As we consider the innovation and acquisition strategy for the VEB portfolio, our brand leads were requesting guidelines on whether they should “stretch” their current brand / trademark into new products and even categories, or if they should launch /purchase new brands to capitalize on the opportunity.

THE RESPONSE

I conducted a study of many brands, both in and out of the beverage category, and across various stages of maturity, to develop a point-of-view on Masterbrand strategy / brand stretching. In sum, there are multiple variables to consider as it relates to brand stretching and different successful brands have applied different strategies toward their portfolio. An excerpt from the the work I solely authored is included in the below carousel.